Zego Data Reveals 5 Rent Payment Trends that Have Emerged as a Result of COVID-19

For weeks, the property management industry has collectively been holding its breath in anticipation of the April rent cycle. With millions of Americans suddenly unemployed, the industry has (rightfully) been on pins and needles to see how many renters would pay or defer April rent.

Here at Zego (Powered by PayLease), we’ve been obsessively analyzing real-time data from our payment platform so that we can share how rent payment behavior is shifting amidst the pandemic. We’ve also been in constant communication with our clients and their residents to hear firsthand about the challenges they are facing. So now that the April rent cycle has come and gone, we wanted to share some notable trends surrounding the struggles our industry is unexpectedly facing.

In April, at least 10% of renters requested payment assistance

The million dollar question apartment owners and operators have been pondering is how many of their residents would be able to pay rent. So it’s probably not surprising that property management companies, regardless of portfolio type, saw an influx of residents requesting assistance with rent. Andrew Greenberg, Vice President at Trilogy Real Estate Management, which is based in San Diego, says “About 10-15% of our resident base have requested a rent deferment plan.”

In the commercial sector, the numbers are about the same. “So far, 12.76% of our [commercial] tenant base has made some sort of request for assistance,” says Robert Phillips, President and CEO of Pacific Coast Commercial. Retail tenants seem to be in the greatest need of help, while office users are next and the industrial sector seems to be holding up the best.”

These numbers are in line with a recent report from the US Department of Labor, which, as of April 4th, estimated that about 10% of the country’s workforce has been unemployed as a result of the pandemic.

But there’s still great uncertainty about how these numbers may fluctuate as time goes on. “Our biggest concern is what will happen in May, as many of these workers will have not worked since March,” says Greenberg.

Many renters with financial hardship are being met with compassion, flexibility

Luckily, renters who are experiencing financial hardship are finding that they won’t be penalized by the clauses outlined in their lease. Instead, these unforeseen circumstances are leading management companies to offer payment relief services so residents can remain in their homes.

“We’re proactively talking with residents to discuss their situation, including waiving late fees and establishing payment plans. Our goal is to keep as many people in place as possible,” says Greenburg.

The National Multihousing Council wholeheartedly agrees with this approach, too. Just recently, they issued a set of recommendations asking apartment operators to refrain from charging late fees, implementing rent increases, and halt evictions during this tumultuous time.

And since there doesn’t seem to be a one-size-fits-all approach to this unique situation, many of our clients are working with residents on a case-by-case basis. “In general our clients/owners of the properties have taken a very sympathetic yet practical approach in responding to the requests for rent assistance. Once we better understand the breadth and impact of the Government assistance available, we will be able to offer the correct assistance for all concerned,” says Robert Phillips.

In-person rent payments sank, while online payments jumped

For those residents who could pay their rent in April, more chose to pay online instead of dropping off a check or making a payment from a retail location.

Zego’s CashPay solution, the alternative to cash and money orders where individuals pay rent via CheckFreePay® retail locations nationwide, dropped nearly 40%. We also saw a 14% reduction in Check Scanning transactions, a process by which onsite managers convert paper checks into digital payments via a desktop scanner, signaling a decline in paper payments.

With more residents wanting to avoid in-person payments, Zego had a 25% increase in new users to our online platform where residents can pay by ACH or credit card. And, the number of online transactions on Zego’s platform increased by 11% from the last rent cycle.

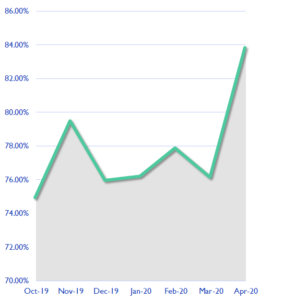

(% of Digital transactions)

But some companies are seeing an even bigger jump in online payments. At Trilogy Real Estate Management. “Online payment utilization is up nearly 50% and we expect that number to continue to climb.”

Credit card transactions spiked, particularly for companies that incur transaction fees

Probably the most interesting trend we saw during the April rent cycle was a spike in credit card transactions. This may be a signal that renters are conserving cash and relying on credit to stay afloat on rent.

Overall, credit card usage rose 31% in April. However, this increase is much more pronounced among clients who are on an incurred pricing model. Zego clients on an incurred pricing model – where transaction fees are absorbed by the management company versus paid by the resident – saw a 117% surge in credit card payments.

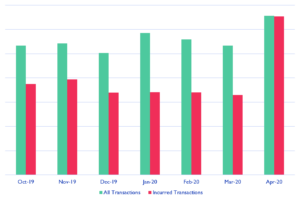

(% of Credit Card transactions)

Historically, we’ve always seen that residents are more inclined to pay digitally when they are not assessed a transaction fee. This is more evident now than ever before. In a time when people are encouraged to stop making unnecessary trips out, and maybe don’t have enough cash on hand to pay rent, incurred payment models are potentially elevating the number of residents who can make a payment.

FREE DOWNLOAD A step-by-step guide to eliminating paper-based rent payments in your communities.

5 Proven steps to reach 100% digital payment adoption

Companies without digital payment options are racing to implement them

Lastly, we’ve seen a recent surge of companies who want to move away from a paper-based payment process and digitize the collection process. In the past few weeks, our organization has tracked a 34% increase in property owners and landlords interested in implementing Zego’s digital payment solution.

Digital rent payments have always had a long list of operational benefits (time savings, resident convenience, and increased security just to name a few). But in the midst of a global health crisis, the benefits are evolving. Having a digital solution in place keeps residents at home, keeps your staff from physically handling payments, and speeds up cash flow when you need it the most. Communities that have only relied on checks and money orders are realizing the importance of digital payment technology.

If your organization is currently in need of digital payments, contact us and we can help you get started. And if you already have a digital payment solution in place, but want to drive more online payments, we can also help. Our latest ebook, The Property Manager’s Guide to 100% Digital Payment Adoption, outlines best practices that you can use to encourage the use of your digital payment solution.